PM Youth Loan Scheme 2025

PM Youth Loan Scheme 2025: The Government of Pakistan has recently advanced its flagship youth-empowerment initiative, the Prime Minister Youth Loan Scheme 2025, designed to provide financial support to young entrepreneurs across the country. The aim is to enable youth to start or expand businesses, promote self-employment rather than job-seeking, and contribute to national economic growth. Recent news shows expanded tiers, streamlined online application processes and significant disbursements to date.

What the Scheme Offers & Recent Developments

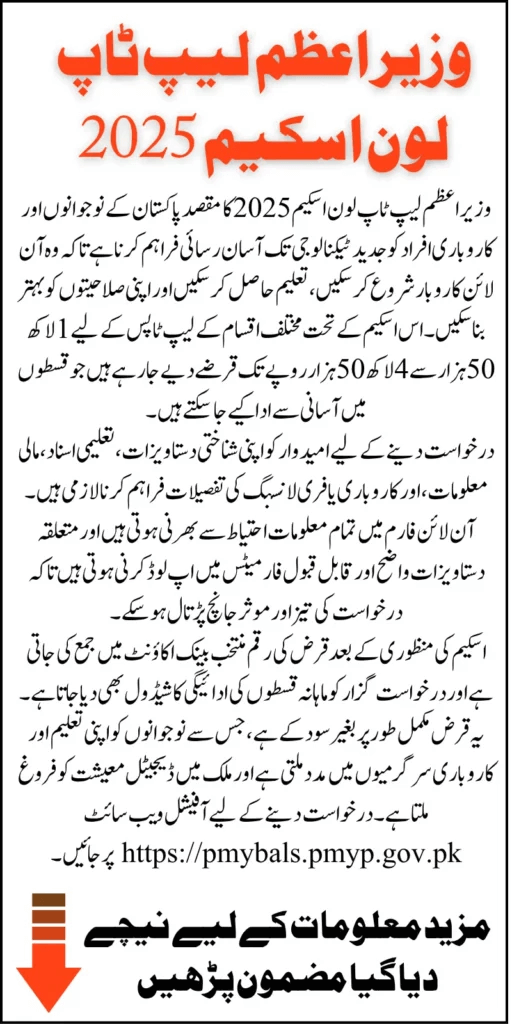

Under this scheme (also known as the Prime Minister Youth Business & Agriculture Loan Scheme or PMYB&ALS), young Pakistanis can access loans under favourable conditions to invest in business ventures, agriculture, IT/e-commerce or other sectors.

Key recent developments:

- The scheme has already disbursed PKR 209 billion to more than 31,700 young entrepreneurs under previous phases.

- A new category for overseas employment & training financing is introduced (one article reports a “Rs 1 million interest-free loan for overseas jobs”).

The online application process has been enhanced for 2025, making it easier and faster for applicants to apply and track status.

Breaking News:BISP 13,500 Installment – November 2025: Check Your District Details

Eligibility Criteria

Applicants must satisfy certain eligibility conditions:

- Must be a Pakistani citizen holding a valid CNIC.

- Age bracket: Generally 21-45 years, though for IT/e-commerce businesses the lower age limit may be 18 years.

- No previous default with a financial institution.

- Must have a business plan or be involved in a new/existing business.

A quota is reserved for women and differently-abled persons to promote inclusivity.

Loan Tiers & Terms

The scheme is structured in tiers, scaling with the size of the business or investment required:

- Tier 1: Generally smaller amounts (for startups/micro-businesses) with lowest or zero markup.

- Tier 2 & Tier 3: Larger amounts, longer repayment periods (up to 8 years) and modest markups.

For example: up to PKR 0.5 million (Tier 1), PKR 0.5-1.5 million (Tier 2), and up to PKR 7.5 million (Tier 3) in some descriptions.

How to Apply Online (Step-by-Step)

The process is fully online and straightforward:

- Visit the official portal of the scheme: pmyp.gov.pk (or the designated application link)

- Register an account: Enter CNIC, mobile number, create password, verify via OTP.

- Fill out the online application: personal details, business details, select loan tier, upload required documents (CNIC copy, photo, business plan, bank account etc).

- Submit the application: After verifying all information, submit and note your tracking ID/reference number.

- Check status online: Use your CNIC and application ID on the portal to see whether your application is under review, approved, or rejected.

Online Nikah Registration Begins in Selected Union Councils Nadra update: A Completed guide

Benefits & Why it Matters

- Promotes youth entrepreneurship, reducing unemployment and driving economic growth.

- Provides access to affordable financing, compared to standard bank loans.

- Encourages women and special-needs persons through quotas and reserved support.

- Opens opportunities in modern sectors (IT, e-commerce, agriculture, exports).

- Government-backed scheme means more trust and oversight.

Important Tips for Applicants

- Prepare a clear, realistic business plan – banks will evaluate viability.

- Ensure all documents (CNIC, photos, bank account) are valid and uploaded correctly.

- Apply early – quotas and funds may be limited for each tier or province.

- Track your application regularly via portal and respond promptly if additional info is requested.

- Stay honest – incorrect information can lead to rejection.

Conclusion

The Prime Minister Youth Loan Scheme 2025 offers one of the best available options for young Pakistanis with business ambitions. With streamlined online application, inclusive eligibility, tiered loan options, and government backing, it presents a real chance to turn vision into venture. If you have an idea, a plan, or an existing small business you want to grow — this scheme may be your launchpad.

Punjab Launches Province-Wide Damage Survey on CM Maryam Nawaz’s Orders: Complete Guide